두 곳 다 대형 자산운용사로 운용사리스크 없음.

수수료는 xlk 0.13% qqq 0.2%

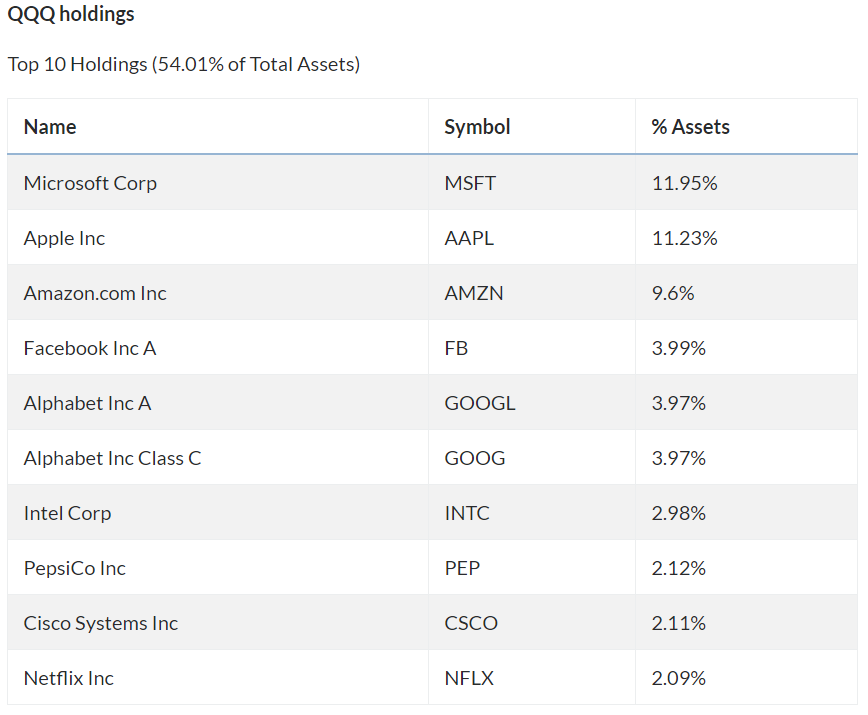

포트폴리오

XLK는 구글과 아마존이 없는것이 특징

https://www.morningstar.com/etfs/arcx/xlk/portfolio

Technology Select Sector SPDR® ETF (XLK) Portfolio | Morningstar

www.morningstar.com

https://www.askfinny.com/compare/QQQ-vs-XLK

QQQ vs XLK - Ask Finny

Both QQQ and XLK are ETFs. QQQ has a lower 5-year return than XLK (15.38% vs 17.46%). QQQ has a higher expense ratio than XLK (0.2% vs 0.13%). Below is the comparison between QQQ and XLK. QQQ XLK Segment Equity: U.S. - Large Cap Equity: U.S. Technology Iss

www.askfinny.com

'주식 > ETF,CEF' 카테고리의 다른 글

| 미국 월배당 CEF - NRO (0) | 2020.06.24 |

|---|---|

| 미국 월배당 CEF - THW (0) | 2020.06.24 |

| 미국 배당 투자 - CEF 폐쇄형 펀드 (0) | 2020.06.24 |

| 미국 ETF - VIG (Vanguard Dividend Appreciation ETF) 배당 성장형 (0) | 2020.04.03 |

| 미국 ETF - VOO (Vanguard S&P 500 ETF) (0) | 2020.04.03 |

댓글