Risk firm: 'American is most at risk' of coronavirus default among US airlines

The worldwide coronavirus crisis has decimated air travel and endangered the solvency of major air carriers — of which American Airlines (AAL) is the most vulnerable, a new study revealed on Wednesday.

According to a new assessment from risk assessment firm RapidRatings, the largest U.S. airline is most in danger of going bankrupt, even after being thrown a lifeline by the Treasury.

“American is the most at risk and that's it in every way you look at it. American stands out as the weakest of this cohort,” RapidRatings CEO James Gellert told Yahoo Finance.

His firm, which has done similar work for McDonald’s (MCD) and Unilever (UL), looks at whether a company can withstand shocks like the COVID-19 crisis, which has devastated the global economy.

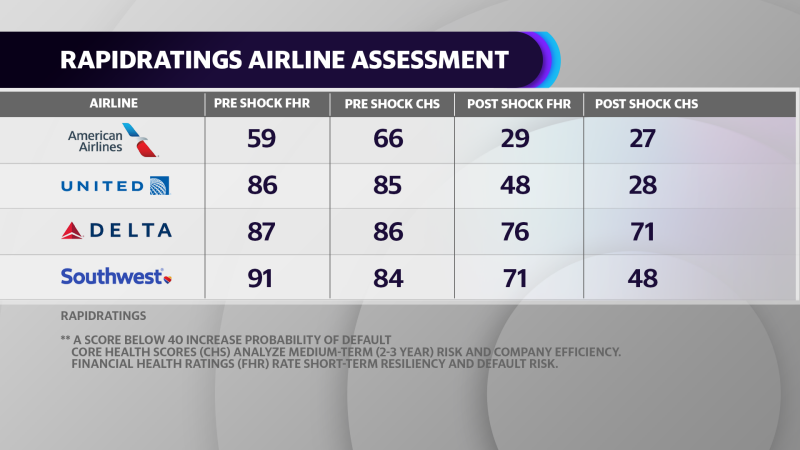

RapidRatings recently conducted comprehensive stress tests on the other major U.S. airlines, including Delta (DAL) United (UAL) and Southwest (LUV), using dozens of variables including debt loads, cash flow analysis and a loss of at least 15% of revenue. Yet over the last three months, the major carriers have sustained much deeper losses, with passenger volumes and revenue plummeting by over 90%.

RapidRatings used the tests to produce a short term financial health rating (FHR) and long term core health score (CHS). The FHR measures a company’s short-term resiliency and default risk while the CHS analyzes risk and company efficiency over a three year period.

View photos

Risk firm: 'American is most at risk' of coronavirus default among US airlines

The summer travel season is a big revenue generator for U.S. airlines but the coronavirus threatens the carriers and risk assessment firm RapidRatings warns American Airlines is the most at risk of going bankrupt.

finance.yahoo.com

FHR 단기자본건전상태

CHS 장기자본건전상태

40점이하는 디폴트의 위험존재

항공주에 투자하고 싶으면 델타나 사우스 웨스트쪽이 안전

출처 야후 파이낸스

'주식 > 개별종목' 카테고리의 다른 글

| 텔라닥 암웰 단순 비교 (0) | 2020.12.18 |

|---|---|

| Tattooed Chef (TTCF) 애널리스트 데이 (0) | 2020.12.17 |

| 리얼티인컴(O)에 갖는 의구심 (0) | 2020.12.17 |

| 암웰 락업 해제일 (0) | 2020.12.16 |

| 미국 배당주식 리얼티인컴(O) vs 스토어 캐피탈(STOR) (0) | 2020.11.19 |

댓글